When it comes to combining practicality and luxury, investing in high-quality timepieces comes to mind for many. For those wondering about the best watches to buy as an investment, it’s key to select pieces that are not only visually stunning and mechanically sound but can also potentially appreciate in value. High-end timepieces from revered brands with enduring demand represent some of the best watch for investment opportunities.

Understanding the Watch Market

To grasp the full potential of investing in watches, one must navigate through the layers of the watch market. It ranges from accessible fashion timepieces to the pinnacle of horology: luxury watches. It’s in this latter category that the best watch to buy for investment is likely to be found.

- Fashion vs. Luxury Timepieces:

- Fashion watches might cater to momentary trends, but they seldom become investment pieces.

- Luxury watches, however, with their masterful craftsmanship and time-tested appeal, may prove to be the best watch to buy as an investment due to their ability to maintain or increase their value over time.

- Brand History and Reputation: The legacy of brands like Rolex and Patek Philippe is built on unyielding quality and an aura of exclusivity that enchants collectors and investors alike.

- Limited Editions and Exclusivity: Limited edition models can spur a frenzy among collectors, driving up resale values due to their scarcity and the unique status they confer upon their owners.

Criteria for an Investment-Worthy Watch

Investment-worthy watches share several vital characteristics that set them apart from passing fads in the market.

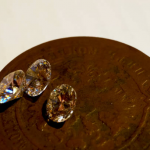

- Craftsmanship and Materials: The best watches to buy as an investment are the epitome of quality, crafted with precision and made from noble materials like platinum, gold, or titanium.

- Mechanical vs. Quartz Movements: Mechanical watches are often more prized by enthusiasts and investors for their intricate engineering.

- Provenance and Previous Ownership: Watches that have an illustrious history can command astronomical sums at auction.

- Rarity and Demand: The exclusivity of certain timepieces can make them desirable as investments due to their low production numbers.

- Potential for Appreciation: Those who own watches with the potential to increase in value hold not just a timepiece, but a legacy on their wrists.

Top Watches to Consider for Investment

Delving into the realm of luxury watches, one can identify a select few that have proven to be astute investments.

- Rolex Submariner – The Diver’s Choice: With a design that has weathered the storms of fashion, the Submariner presents itself as a robust best watch for investment choice due to its long-standing popularity and reliability.

- Patek Philippe Nautilus – A Symbol of Prestige: Esteemed for its distinctive design and the Patek Philippe brand’s cachet, the Nautilus is often cited among the best watches to buy for investment.

| Iconic Investment Watches | Estimated Historical Appreciation |

|---|---|

| Rolex Submariner | 5-10% per year |

| Patek Philippe Nautilus | 10-20% per year |

| Audemars Piguet Royal Oak | 7-15% per year |

| Omega Speedmaster | 4-8% per year |

| Jaeger-LeCoultre Reverso | 3-7% per year |

The Importance of Maintenance and Documentation

For a timepiece to truly be the best watch to buy for investment, it must be well preserved. Proper maintenance not only prolongs the life of the watch but also ensures that it can retain or appreciate in value. When investing in luxury watches, consider the following:

- Regular Servicing: Like luxury cars, luxury watches require regular check-ups to maintain their performance and aesthetics.

- Storing Watches Properly: Environmental factors such as humidity, temperature, and light exposure can affect a watch’s condition.

- Documentation Is Crucial: The original box and papers substantiating a watch’s authenticity can significantly enhance its value and desirability in the collectors’ market.

Risks and Considerations

Investing in watches, like any other form of investment, comes with its own set of potential pitfalls. It is paramount to be aware of these risks:

- Market Fluctuations: The watch market is susceptible to trends, economic conditions, and collector preferences which can all impact value.

- Authenticity Concerns: The market is riddled with fakes and replicas, which can greatly endanger investment returns.

- Insurance and Security: Luxury watches can be a target for theft. Ensuring adequate insurance cover is crucial.

Conclusion

In conclusion, while many timepieces can tell time, only a select few can be deemed a reliable investment. Discerning which watches are the best investment requires an understanding of the market, an eye for quality, and an appreciation for heritage and horology. The best watch to buy as an investment will often combine brand prestige, timeless design, and a proven track record of appreciating value.

To navigate the world of watch investments successfully, it is vital to research thoroughly, maintain your timepieces diligently, and stay informed about market trends. With careful selection and attentive care, your investment can stand the test of time, both as a financial asset and a cherished piece of craftsmanship.

Frequently Asked Questions

- What makes a watch a good investment? A good investment watch generally has a strong brand reputation, high-quality craftsmanship, materials, and design, a history of demand, limited production, and the potential for appreciation.

- Can I expect my luxury watch to increase in value? While not all luxury watches increase in value, certain models from prestigious brands, with historical significance or limited production runs, have a better chance of appreciation.

- How often should I service my investment watch? Most manufacturers suggest servicing mechanical watches every 3 to 5 years to ensure they function correctly and retain their value.

- Is it important to keep the original watch box and documents? Yes, original packaging and documentation can significantly improve the resale value of a watch, serving as proof of authenticity and provenance.

- What are the risks involved in investing in watches? The risks include market fluctuations, the potential for buying counterfeit watches, the requirement for regular maintenance, and the need for secure storage and insurance to protect against loss or theft.